In the Entrepreneurial Mindset, we asserted that serendipity involves both choice and chance as fortune favors the prepared mind. Entrepreneurs shift and expand their Luck Surface Area by focusing on what we can influence – our exposure and response to chance events. Here we discuss ten practices that entrepreneurs can use to expand their Luck Surface Area for success in startups.

The first step in adopting a Serendipity Mindset is to shift the perception that serendipity involves a loss of control and is instead a skill to be developed. Try the Serendipity Mindset Test to assess your openness to serendipity.

Being in the flow increases exposure to favorable opportunities. A prepared mind helps mitigate the negative effects of bad luck and seize serendipitous opportunities to maximize their upside potential. We make our own luck (expand our luck surface area) by being alert for and open to opportunities that frequently arise when we are active and engaged in the world around us.

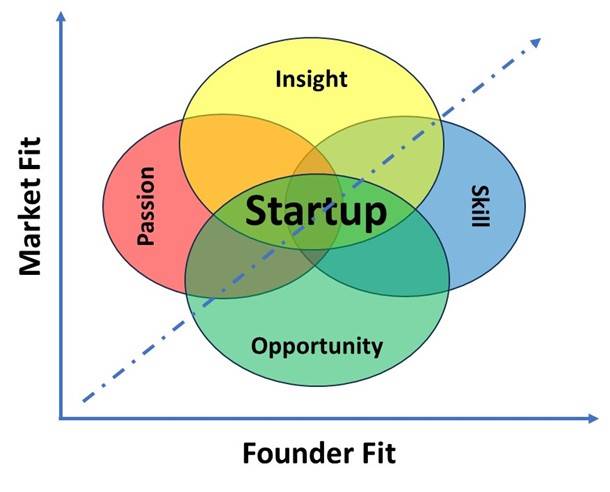

Successful startups begin with insight derived from a prepared mind. Entrepreneurs find Founder Fit by focusing on a problem about which they are deeply passionate and building expertise and insight over time. Figure 1 illustrates this process.

Figure 1: The Prepared Mind: Founder Fit and Serendipity through Passion and Preparation

Before Launching a Startup – Fortune Favors the Prepared Mind:

- Ambition – Think Big: Goals define how we perceive and respond to opportunities. Ambitious goals increase our Luck Surface Area by raising expectations, reaching higher, working harder and taking more risks. Incremental goals promote marginal improvement. BHAGs encourage transformational, long-term thinking. Our aspirations set the boundaries for what we can achieve. Entrepreneurs should shoot for the stars. If they miss, there are many other good options along the way.

- Exercise: What is on your lifetime bucket list? What progress can you make on them in the next 1, 3 and 5 years? What daily and weekly habits accelerate your progress? Keep a daily tracker and weekly journal to monitor your progress and course correct as needed. These habits will serve you well for decades to come as your aspirations evolve.

- Location: Luck involves being in the right place at the right time. Getting to the right place is a variable we control. Where you live is now one of the most important life decisions as it shapes your job opportunities, lifetime earnings and quality of life. Just ten metro areas account for 58% of all U.S. patents and 25 global metros disburse over 75% of all venture funding. Almost all tech unicorns come from these cities, including some 40% from Silicon Valley. Founders of unicorns typically migrated to the metro where they launched their firm. Industries cluster as over 40% of the U.S. semiconductor industry, 35% of biotech and 20% of computer firms are in just two cities. Inventor productivity increases by up to 22% by moving to one of these cities as complex, nuanced information – the type of ideas from which startups emerge – is highly localized and best conveyed in person. Location offers access to talent, insights, best practices and capital so a test for founder ambition is getting to the right place.

- Exercise: Where are the industry experts, leading firms, promising startups and investors in your area of interest? Rate the top three cities. Are you in the right place? How can you get there?

- Build Your Team: Stakeholders – the team, investors, partners and customers – determine potential for any startup in its field. A great team expands the Luck Surface Area enabling the startup to tap emerging market opportunities. Founders of unicorns typically stay in a tech hub for 5-7 years before launching their startup to access startup ideas, capital and talent. Among cofounders of unicorns, 86% had previously worked or studied together. Industry incumbents offer insight into leading technologies and practices spurring ideas for incremental improvements on existing solutions. Promising startups offer insight on how to scale novel solutions.

- Exercise: Who are the foremost experts in your field? How can you best gain access to them? Develop a personal advisory board of mentors and work with experts in your field.

- Networking – Cast a Wide Net: Luck Surface Area is a function of social capital as know-who is often more important that know-how. Networking increases exposure to chance encounters. Energy and enthusiasm convert them into meaningful opportunities. Much as a wide net is more likely to catch fish, weak ties – distant contacts with access to different networks – are the primary source for jobs. Savvy entrepreneurs access ideas, talent and funding through warm introductions by mutual connections.

- Action item: Set annual networking goals and monitor progress in daily tracker. Maintain a key contact list tracking engagement and next steps with these key relationships. Ferrazzi’s Never Eat Alone offers a guide for how this system works.

- Showcase Your Knowledge: Podcasts, public speaking or writing are a leveraged form of marketing to reach a broader, targeted audience. Sharing your knowledge has a dual benefit of honing your narrative and developing channels to reach your target audience. Develop a regular cadence on a theme in which you are an expert to attract a growing and loyal following.

- Exercise: Who is your target audience? What content and knowledge gaps exist in your area of expertise? How could you add value? What media channel best fits your skills? Prepare a list of 10 or more topics that are not well addressed where you can add insight. Get started, develop a regular release cadence, and have fun!

Embracing Serendipity in Your Startup:

- One Yes: Luck Surface Area expands as one’s ability to tolerate “No” increases. Abraham Lincoln lost sixteen elections but only needed to win one presidential election to secure his place in history. The Innovator’s Dilemma besets corporations as only one no is needed to kill a proposal. Entrepreneurs are frequent rejected, especially for truly disruptive ideas, yet startups need only one yes from a key customer or lead investor to survive and thrive. Jeff Bezos at Amazon, Jack Ma at Alibaba, Steve Jobs at Apple and Larry Ellison at Oracle all had difficulty raising their first round of financing. Bessemer Venture Partners publishes an anti-portfolio in part to honor the successful companies they missed.

- Exercise: Develop a business model that embeds rejection into the process. Use lost sales to course correct and improve your win rate over time. Hold yourself accountable by including both wins and learnings from losses in your standard Board report. We have observed that resistance to reporting a Net Promoter Score and sales win/loss analysis is inversely related to ultimate startup success.

- Lean Startup: Companies expand Luck Surface Area through customer responsiveness and seizing opportunities . Lean Startups accelerate time to Product Market Fit through agility by rapidly prototyping with minimum viable products and adapting to customer feedback. Lean Startups preserve capital enabling the ability to scale once customers settle on a Dominant Design.

- Exercise: Devise a system to gather, assess and respond to customer and market feedback. What key hypotheses remain untested by customer demand? What proof points will validate Product Market Fit? How can you test them fastest and most cost effectively?

- Exploration Capacity: Innovative firms have two responsibilities: to exploit current assets and explore future opportunities. Exploitation and exploration are vital, distinct tasks and should remain separate. Otherwise, exploitation drives out exploration in struggles for survival as firms mortgage the future in the quest for efficiency. In Great by Choice, the authors describe a 10X Luck Multiplier effect in which some firms seize a higher return on luck than others even when luck is evenly distributed. IBM won the computer industry by investing heavily during the Great Depression and World War II while others pulled back. Microsoft invested in Windows, Office and developer tools in the early 1990s recession to secure leadership in the computer software market. Amazon expanded its ecommerce offerings during the dotcom crash and in cloud computing during the financial crisis in 2008 to win these markets. Startups should retain separate business development capacity and maintain buffer capital where possible to pursue serendipitous opportunities, especially those that emerge during downturns.

- Exercise: How do you balance exploration and exploitation in your firm? Have you observed a “10X Luck Multiplier” effect in your industry? If so, what enabled one firm to seize the opportunity while others faltered?

- Day One Mentality: “In the beginner’s mind there are many possibilities, but in the expert’s there are few”. Amazon has reprinted its ode to a Day One Mentality in every annual report since its inaugural 1997 letter to shareholders, a mentality that enabled expansion into the “everything store” in the early 2000s and cloud computing, groceries and logistics since then. In The Serendipity Mindset, Busch proposed architecting serendipity triggers into the office layout with open areas and activities such as Friday happy hours. A serendipity culture requires psychological safety and celebrations of serendipity. It may include serendipity champions, serendipity scoring, external assessments of firm serendipity, and scheduled time to discuss unexpected opportunities.

- Exercise: Does your firm have a culture that encourages serendipity? Through what practices is this evident? How else might the firm encourage serendipity?

- Financial Buffers for Serendipity: Beyond Lean Startup practices, serendipity poses challenges for financial managers. Budgets forecast the visible future, which is hazy at best for early-stage firms in rapidly changing markets. Annual financial plans have many benefits for maturing firms, but they are speculative exercises for early-stage firms and may frustrate the flexibility needed to tap serendipity. Tapping the “10X Luck Multiplier” requires organizational slack and buffer capital, which explains why exploitation drives out exploration during downturns. Early-stage firms may consider semiannual plans or rolling annual plans and explicitly discuss favorable and unfavorable changes to the plan each quarter to help reinforce a serendipity culture.

- Exercise: How does your financial process promote both efficiency and serendipity at your firm? How can financial management be adjusted to become an ally in expanding the firm’s Luck Surface Area?

Good luck!

Discover more from Startup Cairns

Subscribe to get the latest posts sent to your email.